19.06.2023 / thinkcx.com

ThinkCX’s new Altnet Investment Scorecard reveals true subscriber take-rates of UK FTTH networks

Investors in the race to sign up fibre subscribers finally get an accurate ROI measurement tool for the UK market

April 18, 2023 – Broadband market intelligence company, ThinkCX, today announced the release of its Altnet Investment Scorecard, the first of its kind providing a detailed and up-to-date analysis of winners and losers in the UK’s FTTH race. Harnessing ThinkCX’s disruptive digital technology, which identifies the residential ISP used by 90% of the UK’s internet households, the Altnet Investment Scorecard affords capital investment firms and market watchers a clear view of ROI by identifying altnets’ accomplishments in signing up actual new customers rather than solely claims of their homes/premises passed. Data for 6 such altnet projects deployed over the last 2 years is also being made freely available today (see below).

“Reliance on ‘premises covered’ as an ROI measurement device is fatally flawed because it only tells half the story and is based on potential subscribers instead of actual subscribers,” said Ron Smouter, VP Sales and Marketing at ThinkCX. “The market has seen the supply of private equity significantly curtailed in recent months as investing firms begin to look more carefully for evidence of success to support their M&A and investment plans. The day of reckoning has arrived with our Altnet Investment Scorecard giving the most accurate picture yet of subscriber take rates – real subscriber acquisition relative to the size of potential subscriber coverage for each FTTH network area.”

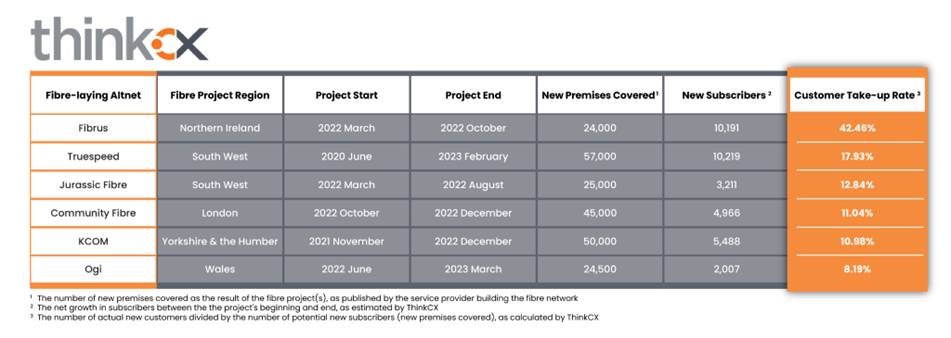

Take-rate data for 6 selected regional FTTH networks in the UK

Access to the complete Altnet Investment Scorecard is restricted but, as part of its launch, ThinkCX is releasing data for 6 investment-backed, regional fibre-building projects undertaken by UK altnets over the past 2 years (see table below).

“The data used here shows that, while the reach of each project is broadly similar (approx. 25,000 to 50,000 new potential subscribers), the take rates tell a wildly different story,” added Smouter. “The highest is 5 times that of the lowest, and only 1 of the altnet projects yielded a new customer take up rate in excess of the roughly 25% ‘break even’ figure for FTTH projects generally assumed by investors.

In any event, measuring the revenues generated by new customers divided by the total investment is a far more direct and meaningful ROI calculation than dividing the number of new premises covered by the total investment. But until now, determining the actual number of new subscribers resulting from a network building project has been a futile undertaking, as the UK altnets generally have no obligation to report their subscriber acquisitions. And frankly, until now, there hasn’t been an objective analytics firm like ThinkCX capable of precisely measuring customer take up rates in the UK’s regional broadband markets.”

Note to editors

It should be pointed out that the customer take up rates in the table above are calculated using retail subscriber data for each altnet, and do not account for wholesale network access supplied to other retailers (if any). The accuracy of the take up rate conclusions are also contingent on the accuracy of the new premises covered claims published by the altnets themselves and their financial backers.

ThinkCX analysts selected these 6 projects for public release because they have a regional focus and are therefore better suited for illustrating measurement than using nationwide figures. The analysts then applied ThinkCX’s proprietary subscriber measurement technology to the altnets’ published ‘total new premises covered’ claims over the projects’ duration to calculate the actual subscriber take up rates.

About ThinkCX

ThinkCX is a data science company focused on serving the communication service provider industry with actionable customer insights from the analysis of large quantities of digital consumer signals. We specialize in the accurate detection and granular measurement of service provider growth across mobility and broadband markets.

Our breakthrough approach enables us to detect market share without asking our clients to share sensitive data, directly contacting subscribers or using personal or private information, or leveraging unreliable small survey panels. Instead, we have developed a privacy compliant, technology-oriented approach that daily analyses billions of anonymous, digital signals that are licensed from thousands of mobile apps. The tactical application of our machine-learning technology assists our clients to not only acquire new subscribers, but also optimise the lifetime revenue of each existing subscriber. ThinkCX currently provides advanced data analytics for most of the top-tier telecom service providers in our domestic Canadian market and is expanding into new country markets such as the UK, Germany and Italy.

Media Contact

Ron Smouter

[email protected]

+1 (866) 575-6549