20.03.2023 / thinkcx.com

ThinkCX charts Virgin Media’s market share turnaround in West Yorkshire

Deep market intelligence on UK broadband subscribers reveals extent to which Virgin Media’s West Yorkshire ‘Project Lightning’ rollout arrested a decline in its local market share and led to net growth

March 20, 2023 – ThinkCX market intelligence today published its latest regional market share snapshot of a leading UK broadband provider, focusing on Virgin Media in West Yorkshire. The study, which uses data with a representation rate of over 90% from ThinkCX’s monthly dashboard of UK broadband subscribers, shows the impact of Virgin Media’s West Yorkshire ‘Project Lightning’ rollout on its market share in the county; specifically, how it arrested its medium-term decline to grow 2.2% in relative terms overall from 2020–2021 (and 3.3% over the longer term, to the end of January 2023). The exercise offers valuable insights into the actual commercial value of major fibre investments rather than simply the numbers of homes passed by new infrastructure builds.

Virgin Media’s nationwide Project Lightning and its relevance to West Yorkshire

In 2017, Virgin Media began a multi-year, multi-billion-pound network expansion plan with the goal of reaching an additional 4 million UK homes with fast 1 Gbps services. The programme was named Project Lightning, and although actual growth was slower than first promised, Virgin Media achieved the 3 million homes passed mark in October 2022.

However, from an investor’s perspective, the most meaningful measure of ROI is subscriber growth relative to the competition. Did Project Lightning’s increase in homes passed result in an actual uplift in market share? Measuring the project’s impact on market share over its broad UK-wide geographical scope and lengthy timeframe would be ineffective because of the myriad of potentially confounding market factors. A better measurement strategy is to compare Virgin Media’s market share before and after a specific regional sub-project, where we can apply time and geographical boundaries.

One such measurable Project Lightning undertaking is for the county of West Yorkshire, where Virgin Media began connecting homes with fibre to-the-premises in various communities in late 2020.

Virgin Media market share in West Yorkshire – before and after Project Lightning

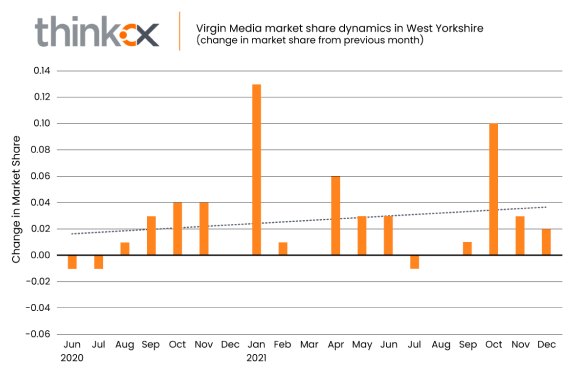

The main measurement period used for this analysis encompasses the last 6 months of 2020 as a benchmark, and then the 12 months to December 2021 to study the impact on consumer take-up as the new networks became available to residents.

At the beginning of the measurement period (June 2020), Virgin Media’s market share in West Yorkshire was 23.04%, and by the end of the period (December 2021), it had risen to 23.55%. This is not overwhelmingly higher (a rise of 0.51% percentage points, or a 2.2% increase), but certainly still a positive and profitable increase over the 18-month period. However, the table below – which indicates the positive and negative changes in market share from month to month – shows that at the beginning of the benchmark period Virgin Media’s market share was actually declining on a month-over-month basis. As local awareness of the project’s launch likely increased during the last half of 2020 and into 2021, consumers increasingly chose Virgin Media as their residential broadband service provider, with some very significant gains recorded in January, April, and October 2021.

“If Virgin Media had been merely holding their own in West Yorkshire the overall market share would have remained constant, and the bars of the graph would have been at or close to 0.00 each month. As it turns out, whether solely because of the network build-out or not, its market share rose by 0.51% over the 18 months, and the bars on the graph show that Virgin gained market share in 12 of those months.

Not only that, and though there was some volatility from month to month, the slope of the trendline reveals that the size of the market share gains themselves also increased through the period. The data indicates that by improving access to its infrastructure and providing access to modern high-speed services, Virgin Media positioned itself well to scoop up more subscribers and grow its presence in West Yorkshire”

Present status of Virgin Media in West Yorkshire

In the 14 months since the end of the period scrutinised above, Virgin Media has continued steadily growing market share in West Yorkshire, although the pace has been slower than in the interval immediately following the network improvements. By the end of January 2023, its overall West Yorkshire market share had increased to 23.81% (a rise of 3.3% since Project Lightning), with only slightly negative month-over-month numbers in just two of those last 14 months.

About ThinkCX

ThinkCX is a data science company focused on serving the communication service provider industry with actionable customer insights from the analysis of large quantities of digital consumer signals. We specialise in the accurate detection and granular measurement of service provider growth across mobility and broadband markets.

Our breakthrough approach enables us to detect market share without asking our clients to share sensitive data, directly contacting subscribers or using personal or private information, or leveraging unreliable small survey panels. Instead, we have developed a privacy compliant, technology-oriented approach that daily analyses billions of anonymous, digital signals that are licensed from thousands of mobile apps. The tactical application of our machine-learning technology assists our clients to not only acquire new subscribers, but also optimise the lifetime revenue of each existing subscriber. ThinkCX currently provides advanced data analytics for most of the top-tier telecom service providers in our domestic Canadian market and is expanding into new country markets such as the UK, Germany and Italy.

Media Contact

Ron Smouter

info@thinkcx.com

+1 (866) 575-6549