26.03.2025 / thinkcx.com

The Growth of Fixed Wireless and Satellite Residential Internet in Canada: 2021 to 2025

Quantifying the Market Share Growth in FWA and Satellite Internet Subscriptions

The Government of Canada’s bold vision of High-Speed Access for All, combined with access to new network technologies and service providers’ continued appetite to grow their market share has resulted in the expansion of alternatives to wired broadband connectivity for Canadian consumers. High-speed connectivity solutions such as Satellite and Fixed Wireless Access (FWA) have become increasingly viable options for Canadian households, especially in rural and underserved areas. In this brief analysis, we will be looking at the increase in market share of wireless broadband subscriptions from 2021 to present in Canada.

Between the two types of alternative connectivity solutions, Fixed Wireless Access (FWA) currently seems to be creating the most industry buzz in North America. In Canada the three major FWA players are unsurprisingly the country’s largest ISPs – Rogers, Bell and Telus – each of whom can leverage their extensive mobile networks and infrastructure to provide residential internet services across broad swathes of the Canadian landscape. There are a few smaller FWA providers, but even their aggregated FWA subscriptions do not have a significant impact on the market share analysis, especially at the national level.

Satellite internet, offered primarily by Starlink and Xplore, has become the fastest-growing alternative in areas lacking fiber or cable infrastructure. The rise of Low Earth Orbit (LEO) satellites has significantly improved coverage, speed, and reliability, making satellite connectivity more competitive than ever. Once Starlink progressed beyond its beta launch in 2021, it’s been the fastest-growing ISP in Canada.

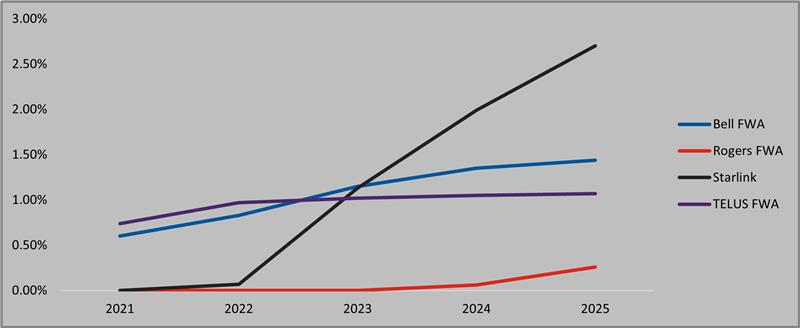

As the graph below indicates, the market share held by FWA and Satellite broadband service providers has increased steadily in the period from 2021 to January 2025.

- As of January 2025, Rogers FWA, Bell FWA, and TELUS FWA hold a combined market share of 2.7% of all residential broadband subscriptions in Canada.

- As of January 2025, Starlink alone (by far the largest Satellite broadband service provider), holds 2.63% of all residential broadband subscriptions in Canada and is on a faster growth trajectory than FWA.

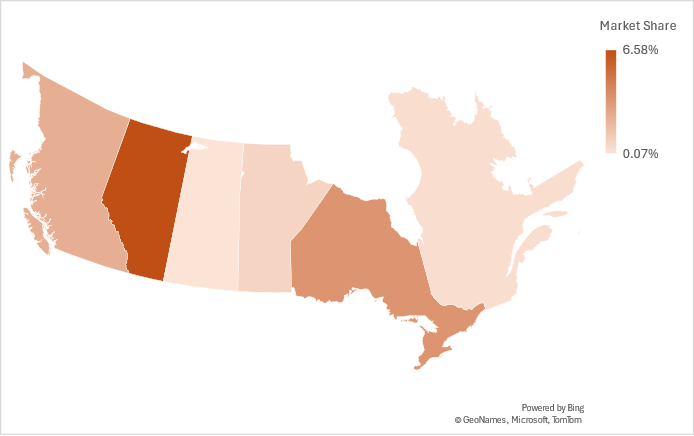

- Of all the Canadian provinces, Alberta has seen the greatest proportionate adoption of FWA and Satellite subscriptions. FWA connections account for 6.58%, and Starlink accounts for 4.74%, for a combined total of 11.32% of all residential broadband subscriptions in Alberta.

About ThinkCX

ThinkCX is a Canadian-based data science company focused exclusively on the telecom market.

Our proprietary market intelligence technology uses a digital, programmatic approach to precisely measure even small changes in market dynamics.

Although some of our commercial outputs may resemble the data produced by more conventional analyst-driven market research firms and survey companies, our digital methods enable us to measure telecom markets at scale. ThinkCX’s sampling rate in some markets can reach as high as 90% of all subscribers in a given geography.

ThinkCX’s market insights help telecoms plan and execute core strategic initiatives, drive acquisitions, and understand the performance metrics of each of their competitors

Media Contact

Ron Smouter

[email protected]

+1 (866) 575-6549